Premium Jute Products Manufacturer & Exporters Eco-Friendly Jute Products Factory Solutions

- Introduction to jute products

: historical perspective and rising global demand - Sustainable advantages and ecological impact of jute fibers

- Technological innovations in manufacturing: enhancing jute product quality

- Competitive analysis: leading manufacturers, factories, and exporters (data table included)

- Customization and private label solutions for business clients

- Real-world applications and successful integration of jute products worldwide

- Conclusion: driving the future of eco-friendly industries with jute products

(jute products)

Introduction: The Evolution and Demand for Jute Products

Over the past two decades, jute products have undergone a significant transformation, evolving from traditional handicrafts to modern, high-value industrial assets. Historically, jute has been central to the economies of Bangladesh and India, comprising nearly 90% of global production as reported by FAO statistics. The global market for jute-based goods reached an estimated value of USD 3.1 billion in 2023, with forecasts predicting a CAGR of 10% through 2030. Primary drivers for this spike include heightened consumer awareness about sustainability, stricter governmental regulations on single-use plastics, and advancements in jute processing technology. Soaring export volumes—over 800,000 metric tons exported annually—reflect an expanding international appetite for robust, eco-sensitive alternatives.

In this context, the role of jute products manufacturer, factory innovations, and exporters has never been more crucial. Today’s industry no longer revolves around basic sacks and ropes; rather, it encompasses a wide spectrum: shopping bags, decor, industrial composites, geo-textiles, and even automotive panels. This comprehensive overview explores the dynamic jute sector, from its sustainability edge to factory tech innovation, industry competition, custom solutions, and real-world use cases.

Sustainable Advantages and Ecological Impact of Jute Fibers

Jute offers intrinsic ecological benefits that set it apart from synthetic alternatives and even rival natural fibers. Cultivation of jute requires minimal use of fertilizers and pesticides. On average, jute consumes less than 10% of the water necessary for growing cotton per hectare and is naturally rain-fed, preserving vital water resources. In comparison, one acre of jute absorbs up to 15 tonnes of CO2 and releases 11 tonnes of oxygen, according to World Resources Institute data. Such impressive figures accentuate jute's role as a climate-positive crop.

Furthermore, jute fibers are 100% biodegradable and compostable within 4-6 months, providing a solution to persistent landfill issues posed by plastics and synthetics. They also possess high tensile strength—up to 500 MPa—making them suitable for heavy-duty applications. Manufacturers and environmentalists alike favor jute for its lifecycle impact: minimal carbon emissions during cultivation, zero petrochemical input, and full circularity upon disposal. These factors combine to render jute products among the most ecologically sound materials for contemporary industry and everyday consumers.

Technological Innovations in Manufacturing: Enhancing Jute Product Quality

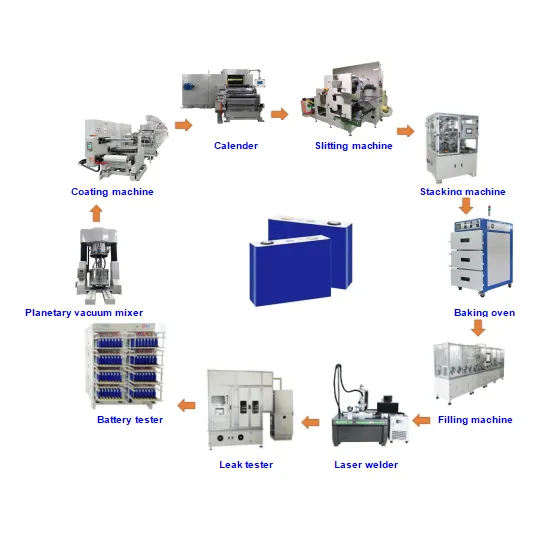

In recent years, the intersection of tradition and technology has fueled advancements in jute goods manufacturing. The adoption of high-speed looms, automated dyeing units, and advanced retting technologies has revolutionized both output quality and consistency. Retting—a key process for fiber extraction—has seen significant upgrades with enzyme-based treatments, reducing water use by up to 50% while improving fiber brightness and uniformity.

Automated cutting and stitching equipment now enable precise, scalable output even for complex product geometries. Digital fabric printing and eco-friendly dyes further expand jute’s design possibilities. Notably, leading jute products factory operations employ AI-driven quality inspections, ensuring defect rates below 1%. Such improvements have enabled factories to meet stringent international certifications—ISO 14001, OEKO-TEX, GOTS—which are essential for large-scale importers and major brands.

Enhanced logistics and ERP integrations streamline supply chains, reducing lead times from an average of 90 days to just 45 days for international consignment, as cited by the International Trade Centre. These technological leaps underpin the competitiveness and global reach of today’s jute manufacturers and exporters.

Competitive Analysis: Leading Manufacturers, Factories, and Exporters

A thriving global market means competition among manufacturers, factories, and exporters is intensifying. Key attributes—such as minimum order quantity (MOQ), certification level, product range, delivery lead time, and customization capabilities—differentiate market leaders. The following data table delivers a comparative overview of prominent industry players:

| Company Name | Country | Annual Production (MT) | Certifications | Product Range | MOQ | Lead Time (Days) | Customization |

|---|---|---|---|---|---|---|---|

| Golden Fiber International | Bangladesh | 60,000 | ISO 14001, GOTS | Bags, Geo-textiles, Fabrics | 1,000 pcs | 35 | Yes |

| EcoJute Ltd. | India | 45,000 | OEKO-TEX, ISO 9001 | Bags, Ropes, Yarn, Mats | 500 pcs | 40 | Yes |

| Global Natural Fibers | India | 35,000 | GOTS, REACH | Fabrics, Bags, Decorative | 2,000 pcs | 50 | Yes |

| Dhaka Jute Crafts | Bangladesh | 25,000 | SEDEX, ISO 14001 | Handicrafts, Carpets | 200 pcs | 60 | Limited |

| Sustainable Fibers Exporters | Vietnam | 18,000 | FSC, ISO 9001 | Bags, Rugs | 300 pcs | 55 | Yes |

These figures illustrate the granularity of competition in the field. Bangladesh and India retain leadership, but new entrants from Vietnam and Southeast Asia signal an evolving supply map.

Customization and Private Label Solutions for Business Clients

Businesses seeking to build unique, branded, and responsible product ranges are increasingly collaborating with jute product factories that offer extensive customization. From bespoke sizes, multi-color printing, and specific GSM selections to tailored packaging and branding, today’s manufacturers cater to a diverse spectrum of retail and industrial segments. Minimum order requirements have dropped significantly—in some cases, as low as 200 pcs—making private label programs accessible even to emerging brands or boutique retailers.

These custom solutions can encompass woven and non-woven fabric types, high-stiffness composites for packaging, and multi-layer laminations for waterproofing or food-safe requirements. Clients can select from a library of existing templates, or submit their own concepts for entirely new products. Digital sampling and CAD prototyping enable clients to rapidly review and iterate before mass production, slashing development cycles by 30-50%. Logistic partners provide drop-shipping and warehouse integration, streamlining entry to global e-commerce channels.

For larger clients—such as supermarket chains, hospitality groups, and promotional product distributors—factories build dedicated production lines, guarantee continuity, and ensure full traceability through blockchain-based batch management, safeguarding brand reputations in international markets.

Real-World Applications and Success Stories of Jute Integration

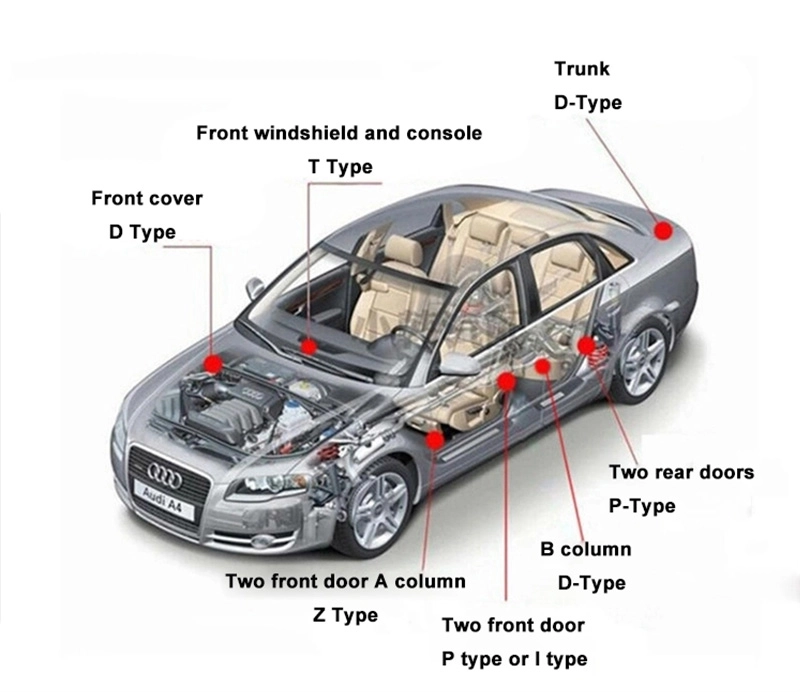

The multitude of applications for jute across industries attests to its unique adaptability. In the retail sector, leading European supermarkets have transitioned to 100% jute shopping bags, reporting a yearly reduction of 10,000 tons in plastic waste since 2017. Fast fashion brands integrate jute tote bags and accessories, while automotive manufacturers such as Mercedes-Benz and Tata Motors reinforce dashboard panels and door trims with jute composites, contributing to lower vehicle weight and improved recyclability.

Civil engineering projects utilize jute geo-textiles in road and embankment construction, achieving cost savings of 20% compared to synthetic alternatives and enhancing soil stability. Hospitality groups employ custom jute runners and placemats for sustainable luxury, while eco-conscious packaging startups leverage jute sacks with water-resistant laminations to meet food-grade requirements. A notable case is the Bangladesh-German jute development program, which deployed over 1.5 million square meters of jute geo-fabrics in flood-prone regions, significantly reducing soil erosion and long-term maintenance costs.

These instances, coupled with strong data, evidence the remarkable value addition and multi-sector integration of contemporary jute products, driving stakeholders toward greener supply chains.

Conclusion: Empowering a Sustainable Future through Jute Products

The jute products industry stands as a beacon of sustainable development in modern commerce. Bolstered by eco-advantages, advanced manufacturing, and a compelling track record in real-world applications, it is primed for continued growth and innovation. Manufacturers, factories, and exporters who invest in technological upgrades and embrace transparency are set to lead in both domestic and export spheres. Customization and agile supply chains further galvanize the sector’s adaptability, allowing jute to remain at the forefront of the circular economy movement.

In a global landscape that increasingly values environmentally responsible solutions, the future trajectory of jute products appears robust. By harnessing their natural strengths and technological advances, the industry promises to facilitate the shift toward truly sustainable products—empowering brands, industries, and environmentally conscious consumers alike.

(jute products)

FAQS on jute products

Q: What are the most popular jute products available?

A: The most popular jute products include bags, rugs, carpets, handicrafts, and rope. These items are known for being eco-friendly and durable. Many jute products manufacturers offer custom solutions based on client needs.Q: How can I find a reliable jute products manufacturer?

A: Look for manufacturers with a good reputation, relevant certifications, and export experience. Reading customer reviews and checking their manufacturing facilities can help ensure quality. Many established jute products factories have online catalogs and responsive customer service.Q: Are jute products suitable for environmentally conscious consumers?

A: Yes, jute products are 100% biodegradable and sustainable, making them ideal for eco-friendly choices. Jute production uses minimal chemicals and supports rural economies. Exporters of jute products often highlight their green credentials.Q: What services do jute products exporters provide?

A: Jute products exporters handle packaging, documentation, and international shipping for clients worldwide. They ensure compliance with global standards and timely delivery. Some exporters offer customization to suit different market preferences.Q: Can I order custom designs from jute products factories?

A: Yes, most jute products factories accept orders for custom sizes, prints, and branding. Clients can collaborate with manufacturers to develop unique products. Minimum order quantities and lead times usually apply.Share

-

Lithium Battery Welding Machine | High-Precision, Fast, SafeNewsNov.17,2025

-

Aluminium Guide Roller | Anodized, Lightweight, Low-NoiseNewsNov.17,2025

-

Tofu Cat Litter Bulk – Eco, Low-Dust, Fast Clumping SupplyNewsNov.17,2025

-

Equipment for Lithium Cell Assembly | Automated & PreciseNewsNov.10,2025

-

Square File Tool – Precision Cut, Hardened Steel, VersatileNewsNov.10,2025

-

Lithium Ion Battery Assembly Machine | Automated, High-SpeedNewsNov.10,2025