Exploring the Benefits of China Square Card Storage Solutions for Convenience and Security

Understanding China's Square Card on File System Implications and Innovations

In recent years, the financial landscape in China has undergone transformative changes, driven by technological advancements and evolving consumer behaviors. One of the notable developments is the emergence of the Square Card on File system. This innovation has not only simplified payment processes but also reshaped the way businesses and consumers interact with financial technology.

What is the Square Card on File System?

At its core, the Square Card on File system is a digital payment solution that enables users to securely store their payment card information with various merchants. This allows for quick and seamless transactions without the need to enter card details repeatedly. Such systems have gained traction globally, but they have found a particularly fertile ground in China, where mobile payment platforms like WeChat Pay and Alipay dominate the financial ecosystem.

In a country that boasts one of the highest rates of mobile payment usage, the Square Card on File system enhances convenience for consumers. They can make purchases with a simple tap or click, expediting the transaction process in an increasingly fast-paced world.

Benefits of the Square Card on File System

1. Increased Convenience With the card details securely stored, users can complete transactions effortlessly, leading to a smoother shopping experience. This is particularly important in the context of e-commerce, where speed can significantly influence consumer satisfaction and retention.

2. Enhanced Security Security is a paramount concern in the digital payment industry. The Square Card on File system employs advanced encryption techniques and tokenization, ensuring that sensitive payment information is protected against fraud. This feature not only safeguards consumers but also bolsters the trust between customers and businesses.

3. Promotes Consumer Loyalty By allowing businesses to store customer payment information, they can streamline the checkout process, making it more likely for consumers to return. This ease of purchasing encourages repeat business, which is vital for growth in a highly competitive marketplace.

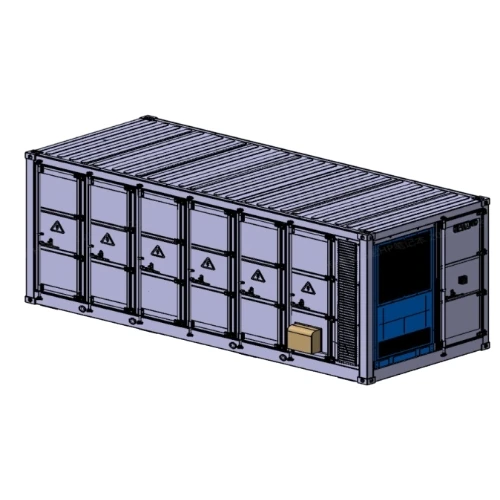

china square card on file

4. Integration with Loyalty Programs Many businesses leverage the Square Card on File system to integrate loyalty programs directly into the payment process. Consumers can earn rewards automatically, enhancing their shopping experience and reinforcing brand loyalty.

Challenges and Considerations

Despite its advantages, the Square Card on File system also faces challenges. Data security remains a pressing concern, and companies must adhere to stringent regulations to protect consumer information. Any data breach can lead to significant reputational damage and loss of trust.

Moreover, while the system simplifies transactions for consumers, businesses must ensure that their backend systems can handle the complexities of secure card storage. This includes adhering to compliance standards set by regulatory bodies, which can vary significantly across regions.

The Future of Payments in China

As China continues to lead in fintech innovation, the Square Card on File system is likely to evolve further. Emerging technologies such as artificial intelligence and blockchain may play crucial roles in enhancing the system's functionality and security.

The integration of biometric authentication, for instance, could streamline the login and payment verification processes, merging convenience with enhanced security. Similarly, leveraging blockchain technology could lead to more transparent and tamper-proof transaction records, thus enhancing trust in digital payment systems.

Conclusion

The Square Card on File system epitomizes the advancements in China's financial technology landscape, making transactions more convenient while ensuring robust security measures. As we look towards the future, it's clear that systems like these will continue to evolve, reflecting the dynamic nature of consumer demands and technological innovations. The ongoing developments in this sector promise not only to reshape the way consumers shop but also to create new opportunities for businesses to engage with their customers in meaningful ways.

Share

-

The Best Lubricants for Aluminum Roller GuidesNewsJul.23,2025

-

Slitting Machine Applications in the Packaging IndustryNewsJul.23,2025

-

Rolling Roller Balancing Techniques for Smooth OperationNewsJul.23,2025

-

How To Optimize An EV Battery Assembly LineNewsJul.23,2025

-

Energy Efficiency in Modern Battery Formation EquipmentNewsJul.23,2025

-

Automation Trends in Pouch Cell Assembly EquipmentNewsJul.23,2025